Income Tax Returns (ITR)

An Income Tax Return (ITR) is a form used to report your gross taxable income for a specific fiscal year. Taxpayers use this form to formally declare their income, deductions claimed, exemptions, and taxes paid, thereby calculating their net income tax liability for the year.

According to the Income Tax Act of 1961, individuals under 60 years of age must file tax returns if any portion of their income is taxable. Additionally, if your taxable income exceeds Rs. 5 lakh in a financial year or if you have paid advance tax, you are required to file an Income tax Return. When filing tax returns, you must also pay any due taxes based on your applicable income tax slabs.

Annual Information Statement (AIS)

The Annual Information Statement (AIS) in income tax filing is a detailed financial report provided by the Income Tax Department. This statement includes extensive information about a taxpayer's financial activities and the related tax deductions for the year. Recently, the Income Tax Department introduced a new feature in the AIS to show the status of information confirmation.

The Annual Information Statement (AIS) enhances transparency and simplifies tax filing by offering taxpayers a comprehensive overview of their income and transactions for cross-verification during income tax return filing. The statement presents both the reported value (as provided by reporting entities) and the modified value for each type of information, including TDS, Statements of Financial Transactions (SFT), and various other details.

New Feature in AIS

Salaried individuals typically file tax returns based on Form 16, which they receive from their employers in June, following the May 31 TDS filing deadline. To avoid interest charges, taxpayers should verify the details and file their returns by the July 31 deadline.

In a press release dated May 13, 2024, the Central Board of Direct Taxes (CBDT) introduced a new functionality in the AIS to display the status of the information confirmation process.

The new feature in the AIS will indicate whether the taxpayer's feedback has been addressed by the source, showing whether it has been partially or fully accepted, or rejected. For partial or full acceptance, the source must file a correction statement to rectify the information.

What Taxpayers Can Check while filing ITR

Feedback Confirmation Status

This shows if the feedback has been shared with the Reporting Source for confirmation.

Feedback Shared On

This provides the date on which the feedback was shared with the Reporting Source.

Source Responded On

This indicates the date on which the Reporting Source responded to the feedback.

How to Check AIS

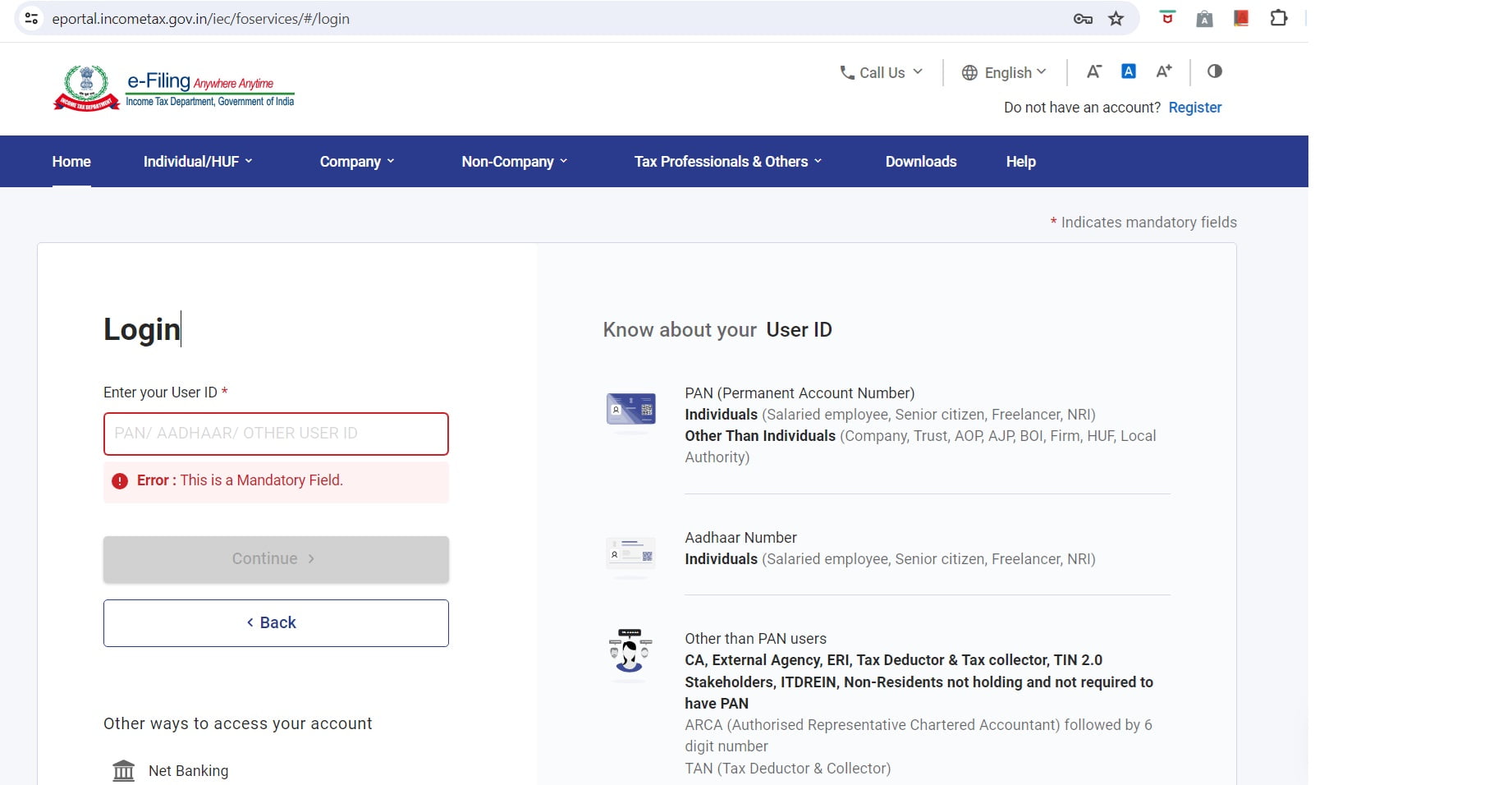

- Log in to [the Income Tax Department website](https://www.incometax.gov.in/).

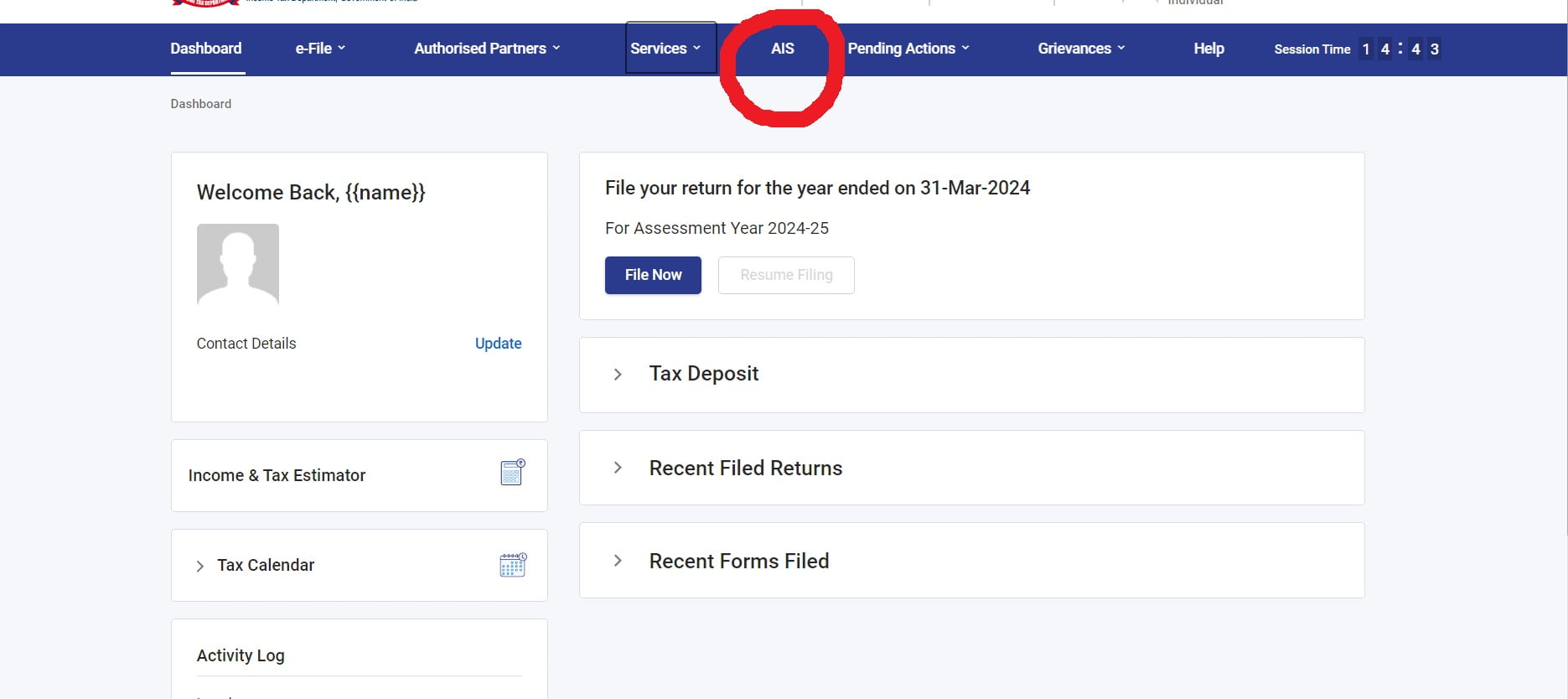

2. After logging in, click on the "Annual Information Statement (AIS)" menu.

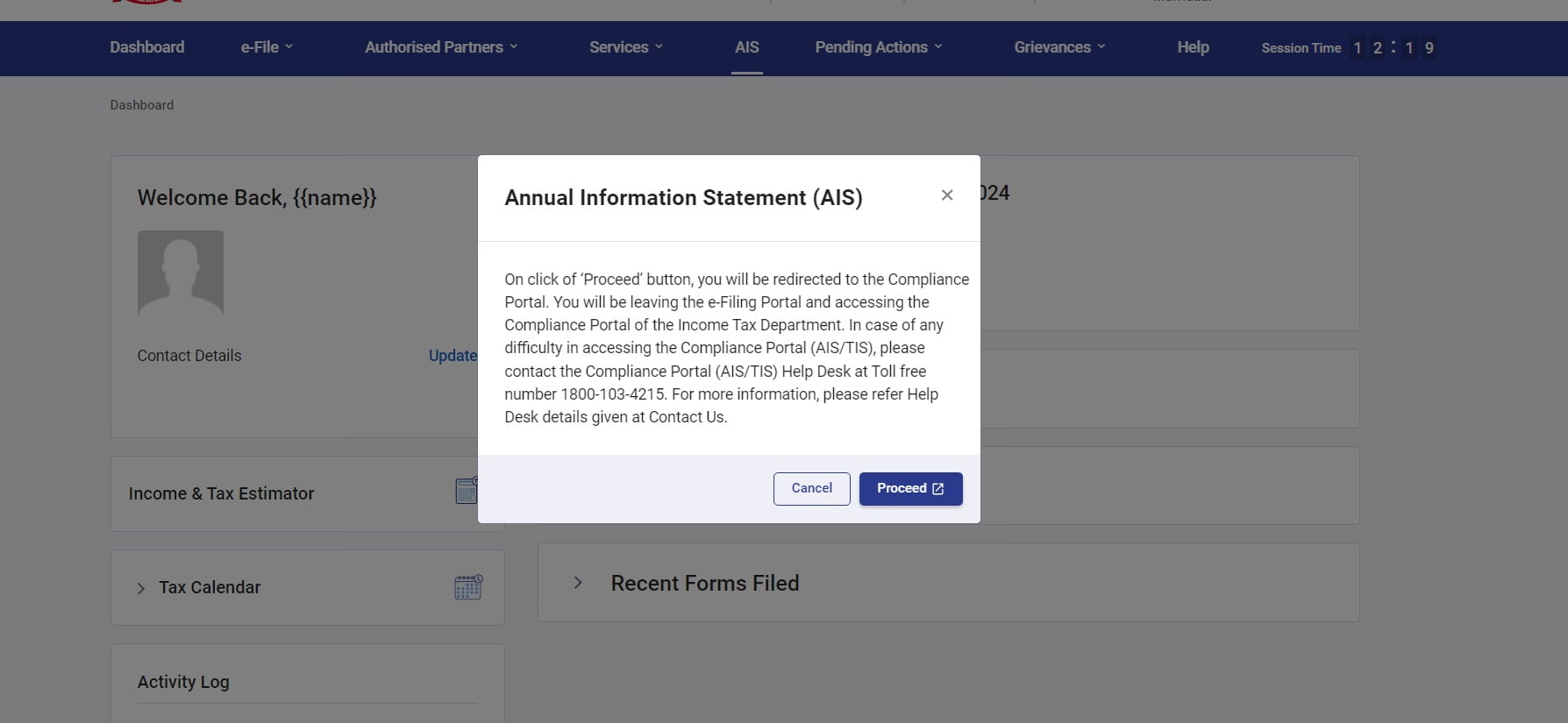

3. Click the "Proceed" button to be taken to the AIS portal, then click on the AIS tile to view the statement.

How to Submit Feedback on the Information

Taxpayers can submit feedback on the information displayed under TDS/TCS Information, SFT Information, or Other Information by:

- Press the "Optional" button in the Feedback column for the relevant information, which will direct you to the "Add Feedback" screen.

- Choosing the relevant feedback option and entering the feedback details (depending on the selected feedback option).

- Click the "Submit" button to submit the feedback.

For more information, go to the AIS section under the e-File/AIS menu after logging in.

(Disclaimer: The above article is intended for informational purposes solely and should not be construed as investment advice. FINOSTRY advises its readers/audience to consult with their financial advisors before making any decisions related to money matters.)