Amazon Pay ICICI Credit Card: Enjoy Unlimited Cashback with the Lifetime-Free Benefit

Looking for a lifetime free credit card with unlimited cashback for your spending? Then here's a credit card that gives you unlimited cashback on every spend—without charging any joining or annual fee. Sounds too good to be true? The Amazon Pay ICICI Bank Credit Card is a co-branded, lifetime-free card powered by Visa designed to make your shopping experience smarter and more rewarding.

This card offers a host of benefits, including:

- Unlimited cashback on every transaction.

- No joining or annual fees on your card.

- Simple onboarding process with paperless documentation and quick video KYC.

- Instant card issuance—get your digital card within 30 minutes.

- Cashback as Amazon Pay Balance with no expiry date, so your rewards keep adding up.

- Auto Credit of Rewards: Each point equals ₹1 and is credited directly to your Amazon Pay balance.

Every time you make a payment, your cashback is automatically credited as Amazon Pay Balance. There is no capping on the cashback and you can use the Amazon pay balance on your shopping, recharge mobile phones, and on other spends.

Amazon Pay ICICI Credit Card Overview

Category

Cashback as Amazon Pay Balance

Benefits

Cashback, Domestic Airport Lounge Access, Fuel Surcharge Waiver

APR

29.99% annual percentage rate

Return

1% to 5%

Welcome Benefit

NIL

Joining Fee

NIL

Annual Fee

NIL. Lifetime Free

Annual Fee Waiver

Not Applicable.

Eligibility

18-70 Years

Minimum & Maximum age of the applicant

25000

Minimum monthly income

700

Minimum Credit Score

Also Read: AU Bank Credit Card- Apply for Lifetime Free

How to Apply

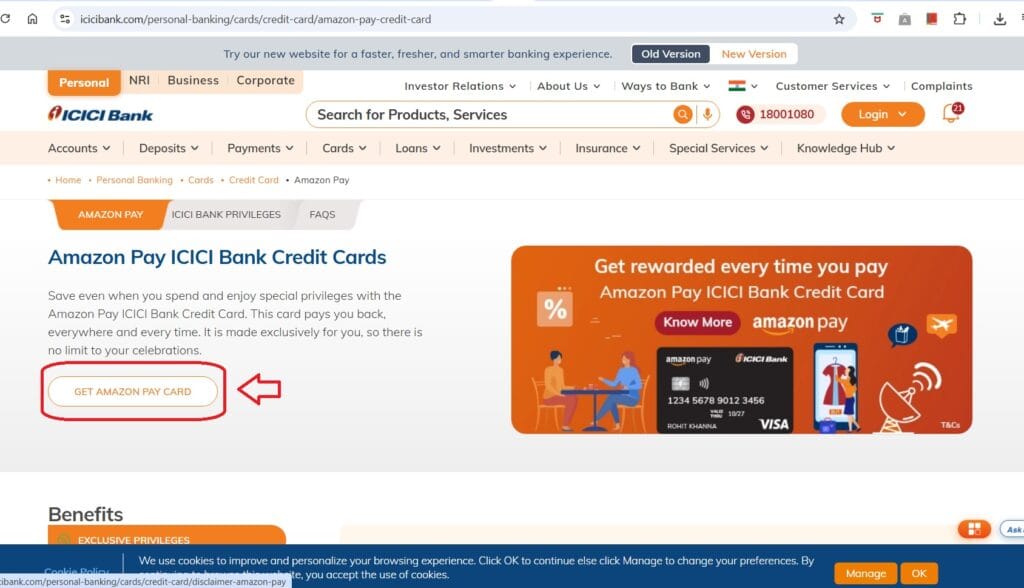

Through ICICI Bank Website:

- Visit ICICI Bank Official Website and Click on Card Section.

- Search for Amazon Pay Credit Card and Click on 'Apply Now'.

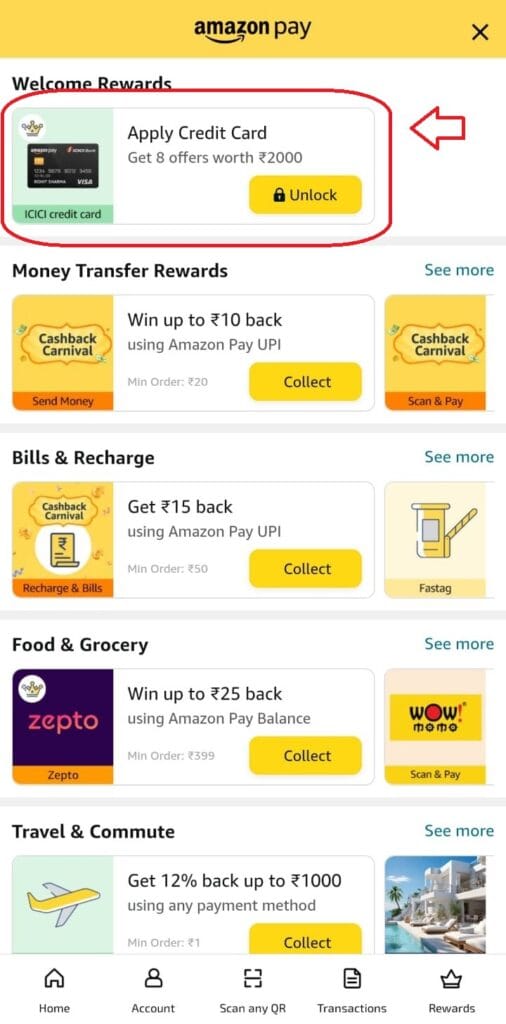

Through Amazon :

- Visit Amazon.in or Amazon application.

- Go to 'Amazon Pay' section from the menu.

- Scroll down to look for the apply click of Amazon Pay ICICI Bank Credit Card.

Cashback

With this card in your wallet, every cashback is credited as Amazon Pay Balance making every purchase a very rewarding experience. It’s the perfect pick for those who shop smart and love getting more out of every transaction.

| SPEND CATEGORY | CASHBACK % | CAPPING |

|---|---|---|

| Earn 5% cashback every time you shop on Amazon if you are an Amazon Prime Member. | 5% | No capping |

| Enjoy 3% cashback on your shopping at Amazon if you are not a member of Amazon Prime. | 3% | No capping |

| Use this card on Amazon Pay and get 2% cashback on spending at 100+ partnered merchants. | 2% | No capping |

| Earn 1% cashback on other spends on shopping, dining and travel including insurance premium payments. | 1% | No capping |

The following expenditures are ineligible for cashback on the Amazon ICICI Credit Card:

- Spends that are converted to EMI.

- Fuel Spends.

- Purchase of physical and digital gold on Amazon.in

- Purchases made at other Amazon marketplaces (including Amazon.com, Amazon.ca, Amazon.co.uk, Amazon.de, Amazon.fr, or Amazon.co.jp) will be eligible for 1% cashback.

- Amazon Business transactions.

Complimentary Airport Lounge Access

Airport Lounge Access in India: 1 visit/quarter

Airport Lounge Access outside India: Unavailable

With the Amazon ICICI Credit Card, enjoy four complimentary domestic lounge visits within India per calendar year. If you're an occasional domestic traveler, this card provides convenient lounge access. Please note, that to qualify for complimentary airport lounge access, there's a minimum spending requirement of Rs 75,000 over the last three calendar months and you need to be an Amazon Prime Member.

Optimizing Cashback Benefits on the Amazon Pay ICICI Credit Card

Amazon Pay ICICI Credit Card is a lifetime free card with no joining and annual fee. Let's focus on the ways to maximize the cashback benefits in each category instead.

If your monthly spend on Amazon Pay ICICI Credit Card is Rs. 25,000 and considering on the following spends on category base. Your monthly cashback comes to Rs. 750.

| SPEND CATEGORY | MONTHLY SPENDS | CASHBACK |

|---|---|---|

| Spend on Amazon (Considering Prime Membership- 5%) | 10,000 | 500 |

| Spend on Amazon Pay Preferred Partner, including Insurance payments and Government Payments (2%) | 10,000 | 200 |

| Other Spends ( 1%) | 5,000 | 50 |

This strategy results in a total spend of Rs. 3,00,000 on these categories within a calendar year, yielding an overall reward rate of 3% which is quite advantageous.

Final Thought

Amazon Pay ICICI Credit Card an entry-level cashback credit card, offers 5% to 1% cashback as Amazon Pay Balance. So if you are an Amazon Prime Member and shop frequently on Amazon then this is a must have card. Moreover, where maximum credit cards provide reward points on spending and charge a redemption fee on redemption, Amazon Pay ICICI Credit Card offers direct cashback as an Amazon Pay balance with no capping and expiry benefits.

However, it may not be the top pick for everyone. The reason? The 5% cashback benefits are mostly limited to the Amazon expenses and cashback is credited as Amazon Pay Balance.

In contrast, the SBI Cashback Credit Card gives 5% cashback on all online transactions, irrespective of the platform—making it a more appealing preference for those who like flexibility in their spending.

But a more appealing benefit of the Amazon Pay ICICI Credit Card is you can earn 2% cashback on Paying payments on Utility Bills, Insurance Premiums and Government Transactions and even 1% cashback on Jewellery Purchases which is typically not found on most cashback cards.

Frequently Asked Questions

Yes, it gives unlimited cashback on every spend—without charging any joining or annual fee.

Yes, you're entitled to four visits per year, contingent upon meeting a spending requirement. You must have made purchases totaling Rs 75,000 within the last three months and be a amazon prime member to qualify for complimentary airport lounge access.

It comes with a wide range of benefits, including easy and secure online payments, attractive cashback rewards, and flexibility to use it across multiple platforms and partner merchants.

A 1% fuel surcharge waiver applies to all fuel transactions made with this credit card.

Beginning with two credit cards is a good choice and help you to score a better credit history.

Best Credit Cards for ₹25,000 Monthly Income:

- SBI Simply Save Credit Card

- YES Bank Prosperity Rewards Plus Credit Card

- HDFC MoneyBack Credit Card

- ICICI Platinum Chip Card – Visa

- CITI Cashback Credit Card

- Standard Chartered Platinum Rewards Credit Card

- SBI SimplyCLICK Credit Card

- ICICI Coral Credit Card – Visa

These cards are well-suited for individuals with a moderate income and offer a mix benefits of cashback and rewards.

Disclaimer: The views and opinions expressed are solely those of the author and do not necessarily reflect the official policy or position of Finostry. The information provided in this review is for informational purposes only and should not be considered as professional advice.