Breathtaking Dividend Updates: Vedanta, Railtel corporation of India, Shukra Pharmaceuticals and other companies

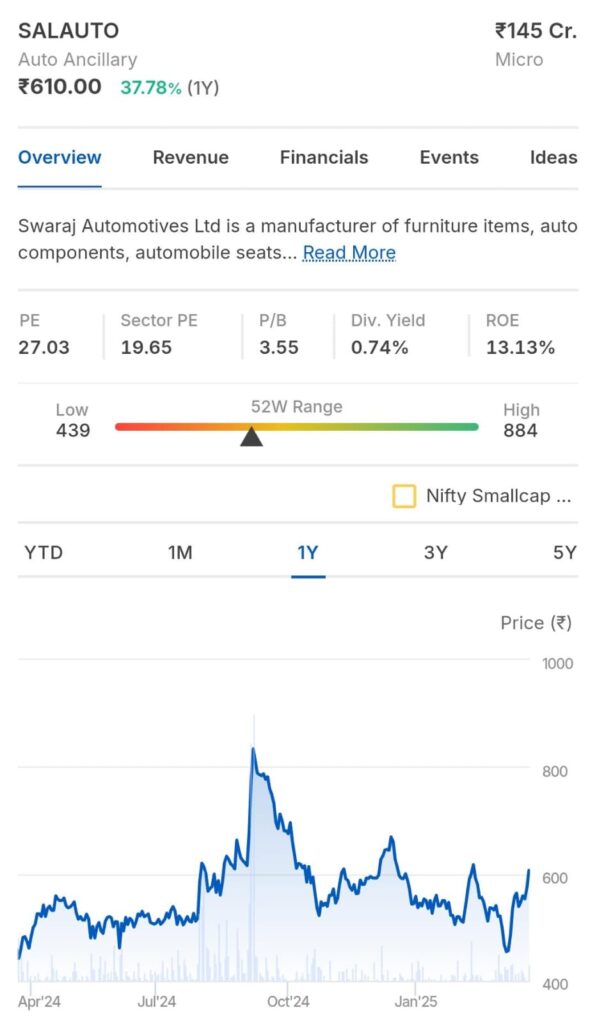

SAL Automotive Limited Announces 1:1 Stock Bonus – What It Means for Investors

In the last trading session, SAL Automotive Limited witnessed a 2.5% surge in its share price, closing at ₹559. Adding to the excitement, the company has officially announced a 1:1 stock bonus for its shareholders, coupled with a competitive policy aimed at rewarding investors.

What Does a 1:1 Bonus Mean?

This announcement is significant, especially for investors who also seek income alongside capital appreciation.

A 1:1 stock bonus means that for every one share you own, you will receive an additional share as a bonus. Essentially, this doubles your total number of shares without requiring any additional investment.

For example, if you currently own 100 shares of SAL Automotive, after the bonus issuance, your holdings will increase to 200 shares. However, while the number of shares doubles, the stock price may adjust accordingly to reflect the bonus issuance.

When Will the Bonus Be Issued?

The ex-date for the stock bonus is the record date, which means only investors who hold shares before this date will be eligible to receive the bonus shares.

This move by S A L Automotive is expected to boost investor confidence and enhance liquidity in the market. Stay tuned for further updates on the stock’s performance!

Crisil Limited Announces ₹26 Dividend – Key Details for Investors

In the last trading session, Crisil Limited closed on a positive note, registering a 0.3% increase and settling at ₹4,390. Adding to the good news, the company has officially announced a ₹26 per share for its shareholders.

Dividend Details

Crisil Limited will be distributing a ₹26 dividend for each share held. This means that if you own 100 shares, you will receive ₹2,600 as a dividend payout.

Ex-Dividend Date

To be eligible for this dividend, investors must hold Crisil shares before the ex-dividend date, which is April 14, 2025. If you purchase shares on or after this date, you will not be entitled to receive the dividend.

This announcement makes Crisil an attractive option for dividend-seeking investors. Stay tuned for more market updates and investment insights!

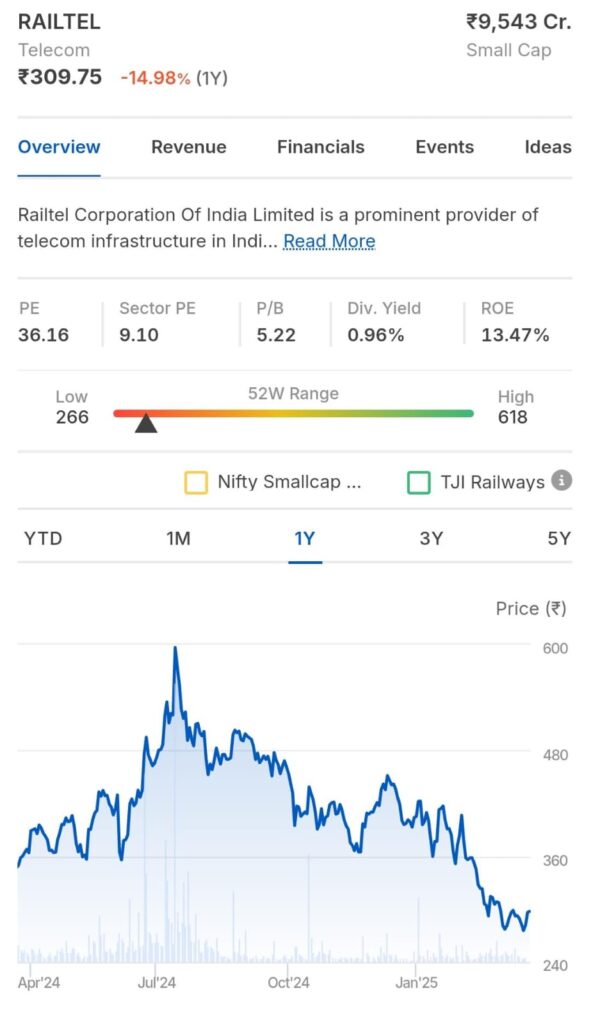

Railtel Corporation of India Announces ₹1 Dividend – Key Investor Update

In the last trading session, Railtel Corporation of India Limited witnessed a decline of over 3%, closing at ₹274. Despite the correction, the company has made an official announcement regarding its dividend payout, bringing some positive news for shareholders.

Dividend Details

Railtel Corporation has declared a ₹1 per share. This means that for every share you own, you will receive ₹1 as a payout.

Ex-Dividend Date

To be eligible for this dividend, investors must hold Railtel shares before the ex-dividend date, which is April 2, 2025. Any shares purchased on or after this date will not qualify for the dividend.

This announcement provides an added incentive for existing shareholders while reinforcing Railtel’s commitment to rewarding investors. Stay tuned for more updates on stock performance and market trends!

Shukra Pharmaceuticals Announces 1:10 Stock Split – What Investors Need to Know

In the last trading session, Shukra Pharmaceuticals Limited saw its stock hit the upper circuit of 2%, closing at ₹250. Adding to the momentum, the company has officially announced a stock split in a 1:10 ratio.

What Does a 1:10 Stock Split Mean?

A 1:10 stock split means that each existing share will be split into 10 new shares. This means that if you currently own 1 share of Shukra Pharmaceuticals, after the split, you will have 10 shares. Similarly, if you own 100 shares, your total holdings will increase to 1,000 shares. However, while the number of shares increases, the price per share will be adjusted accordingly.

Ex-Split Record Date

The record date for this stock split is March 21, 2025. Investors holding shares before this date will be eligible for the stock split.

This move aims to enhance liquidity and make the stock more affordable for investors. Stay tuned for further market updates and insights!

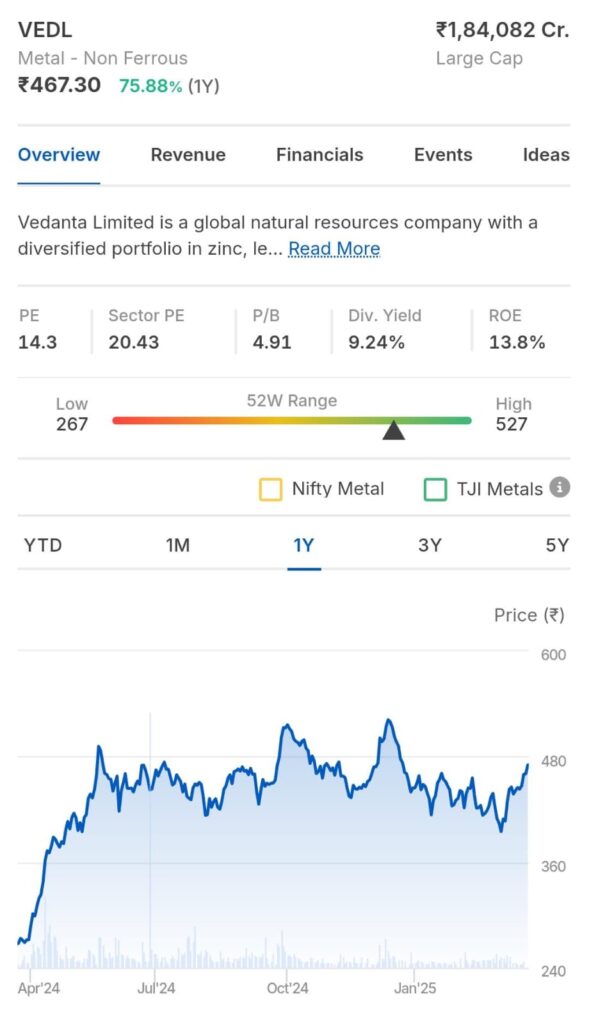

Vedanta Shares Surge – Analysts Predict Strong Growth Ahead

In the last trading session, Vedanta’s stock rose by 1%, closing at ₹447. Now, a major and positive update is emerging for investors, as many analysts remain bullish on Vedanta’s future performance.

Vedanta’s Potential Targets

According to market experts, if you hold Vedanta shares for 1 to 3 years, the potential price targets are:

- ₹550 (short-term, achievable by the end of this year)

- ₹650 (mid-term)

- ₹800 (long-term)

These targets indicate strong growth potential, making Vedanta an attractive investment opportunity. The ₹550 mark is considered easily achievable within the near future, presenting an exciting prospect for investors.

With positive market sentiment and strong fundamentals, Vedanta remains a stock to watch. Stay tuned for more updates on its performance!

(Disclaimer: The above article is meant for informational purposes only, and should not be considered as any investment advice. FINOSTRY suggests its readers/audience to consult their financial advisors before making any money related decisions.)